It is a common refrain that, in a crisis, asset price correlations move towards 1. What was once independent is no longer so, as a large common driver has emerged creating large and often forced flows from leverage unwinds and VaR models that then feed on themselves. This is shorthand – what really happens is correlations move to extremes.

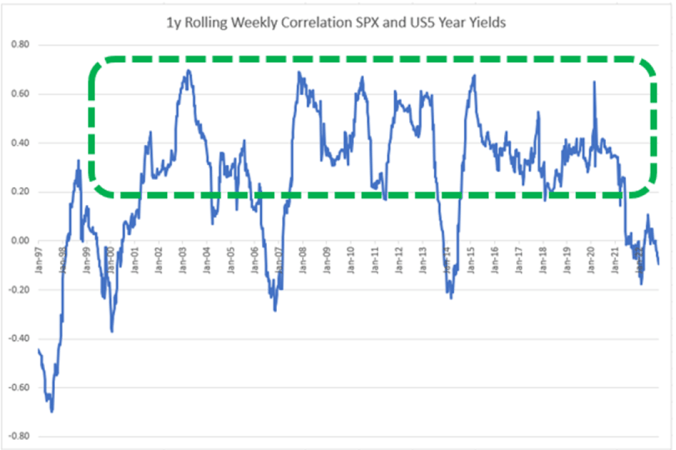

Over the past 40 years or so, generally speaking, stocks and yields have been positively correlated. There were a couple of short-lived hiccups around the taper tantrum and early 2007 which soon reversed. In previous periods of stock weakness, you can see the correlations move decidedly higher.

We aren’t the first to write about this being the foundation of most portfolio allocations. Yields drop and bond prices go up. A positive carry reliable portfolio diversifier- the holy grail to those that practice the dark arts of optimization. We also aren’t the first to point out this has been made possible due to generally low and steady inflation, meaning in periods of crisis or economic weakness it has been fairly easy for central banks to ease policy, underpinning the correlation. This chart from Goldman Sachs illustrates this.

Risk parity portfolios are an example of this type of construction. Sometimes they add in other asset classes as well – credit, REITs, commodities etc. One drawback as we see it: they are long only. When correlations move toward 1 in a crisis, and you are constrained long only, you only get to choose from one side of the return distribution; you need the asset to go up. Managed Futures have shined in previous periods of crisis, and done well as an equity market diversifier, by capitalizing more fully on the correlation moves. They allow exposure to the big negative correlations also, and in more places than investors typically have exposure – like currency markets. To our eye this is a huge improvement over long only methods of portfolio construction, and why we think Managed Futures strategies warrant a place in all types of portfolios.

Take crude oil for example. In a crisis, correlations move to extremes. Sometimes that correlation is near 1 like in 2008 as crude as crude collapses alongside stocks. Sometimes that correlation is near -1 as in early 2022 as crude gained and stocks fell. You need the short side of markets to capture the broadest range of moves to correlation extremes that you can. Managed Futures, in a crisis, hones in on the big flows and macro uncertainty that hurts equity markets whether those moves are caused by other markets going up or going down. 2022 is a great example of the need for both long and short exposures. The stock markets prime concerns in 2022 have been soaring commodity prices and collapsing bond prices. Strategies that rely on only the long side are at a disadvantage.

(PS – Couple of smaller points – on Managed Futures execution, it helps to do another couple of things under the hood, which we have written about in the links that follow. First, when Managed Futures are locked in to diversifying positions in a crisis mode – hold on. Don’t adjust positions just when the volatility picks up. More here. And second, stick to major markets. It is those that cause the systemic issues or capture the biggest crisis flows. More on that here.

You must be logged in to post a comment.