It is a common refrain that, in a crisis, asset price correlations move towards 1. What was once independent is no longer so, as a large common driver has emerged creating large and often forced flows from leverage unwinds and VaR models that then feed on themselves. This is shorthand – what really happens is correlations move to extremes.

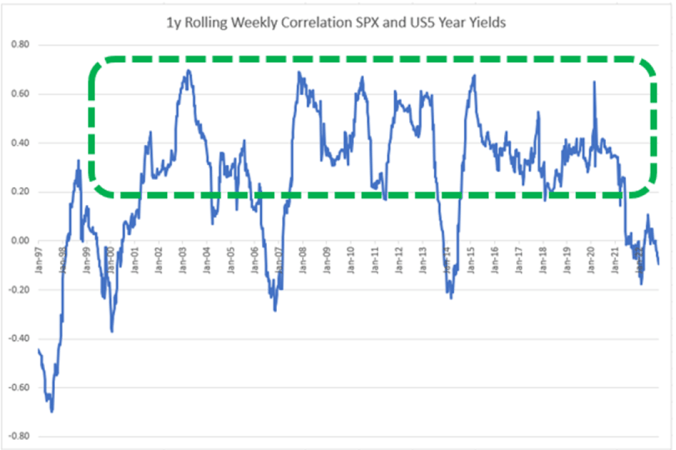

Over the past 40 years or so, generally speaking, stocks and yields have been positively correlated. There were a couple of short-lived hiccups around the taper tantrum and early 2007 which soon reversed. In previous periods of stock weakness, you can see the correlations move decidedly higher.

You must be logged in to post a comment.