The turn of calendar years are interesting times to take stock of how market prices evolved compared to what was expected to transpire a year or two ago. This can serve as a great lesson in humility and an appreciation in the uncertain nature of the world. We also think it makes the case for investment strategies that can adapt and navigate uncertainty to shift allocations in broader portfolios.

Remember the end of December 2021? Interest rates were at rock bottom pandemic levels (itself an exercise in who-knows-what-can-happen) while the S&P 500 was around 4800, riding high on free money forever. Fed Funds futures markets at that time expected December 2023 rates to be about 1.4%….by December 2022, those forward looking interest rate expectations had moved to 4.65%, CPI had hit 9% in the summer of 2022 and the stock market had fallen 20%. Inflation and interest rate fears were everywhere. Over the course of 2023, interest rates actually went up higher than expected – currently 5.33% – and as of December 31, 2023, the stock market is within a whisker of 4800 again.

When it comes to markets and the economic environment, nobody knows anything for sure. The NY Fed puts out forecasts for output growth over the next few years, the most recent one is below. With 90% confidence, four quarter percentage change in output growth in the US over the next year should be between -6.9% and +9.6%. That’s a 16% band! So, the smartest people in the room are sure of at least one thing – the world is very uncertain and there are no crystal balls.

Portfolios need to have elements that can adapt to diversify across a wide range of outcomes. A popular framework is the quadrants approach – balancing risk in assets that do well in different combinations of inflation and growth. After decades of low and steady inflation in developed markets – even after periods of incredibly loose monetary policy and decently tight labor markets – many portfolio constructs ignored the high inflation box and just focused on protecting against the low growth outcome, relying on bonds alone to diversify. When inflation came roaring back, these portfolios struggled. Managed Futures shined for a couple of reasons related to inflation. First, it allows short exposures in fixed income. Second, it has a bigger toolbox of assets to allocate to, including commodities and currencies. This combination allows Managed Futures to adapt to the changing environment.

Keeping in mind that there is no crystal ball, what sources of uncertainty do we see on the horizon as we look ahead to 2024? And how does that create opportunity for Managed Futures? Big questions. Markets tend to move aggressively when things don’t turn out as expected and Managed Futures can be framed as exposure to this uncertainty.

Let’s start with the big markets.

Stocks

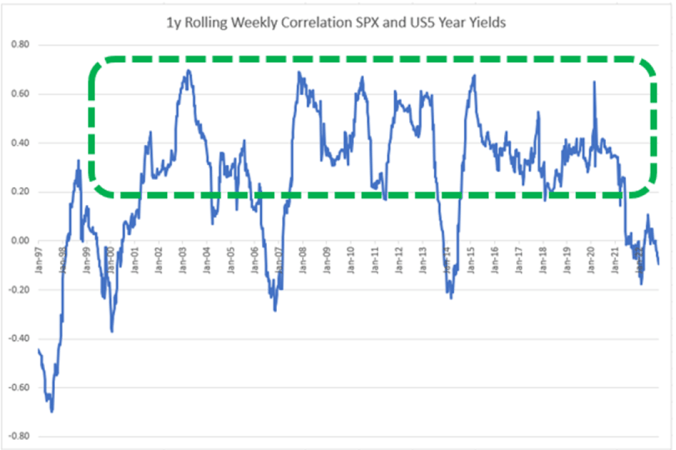

The stock market is close to record highs and trading at fairly expensive multiples – assuming 2023 SPX earnings come in at the 215 currently expected, we are at a 22 PE. Using 2024 expectations of 240, you get a forward PE a little under 20. Over the last few months, the valuation multiple has expanded. This has been driven in part by the expectation of interest rate cuts over the next couple of years being sooner and greater than previously expected, as inflation normalizes, and the Fed reaction function is being reassessed. We will see how that plays out, but stocks are not cheap right now and priced for a smooth, soft landing. It sure seems like a good time for the diversification Managed Futures can provide.

Fixed Income and Currency

Rates look to have peaked and markets assume inflation is solved but markets have sure been wrong before on the pace of inflation reduction as well as the Fed reaction function. These are complex, reflexive systems. If they are right, Managed Futures will move to long positions in fixed income. If inflation is stubborn, however, and doesn’t continue to come down as quickly or the Fed is spooked by the rapid loosening of condition, yields could go back up. The USD implications of a shifting monetary policy landscape are also large, as the past few years have seen a strong dollar against major currencies driven in part by rate differentials. Witness the large move down in the Japanese Yen over the past few years. US rates went up 500bps, at 75bps a clip for a time, while the Japanese maintained the Policy Balance Rate at -10bps. Should the Japanese decide to end the period of extraordinarily low rates while the US is cutting rates by 150bps, we could see large shifts in the yen. FX moves are often driven by diverging monetary and fiscal policy stances – the last mile of inflation may well be bumpy and experienced differently in different countries. We also have elections in the US and the UK that could usher in very different policy. Chinese stimulus measures and the subsequent impact on the ‘commodity’ currencies of Australia and Canada could also drive currency volatility and uncertainty. Managed Futures offers exposure to these different countries and currencies.

Commodities

We see similar potential for moves in commodity markets, where there are growing imbalances. Copper is a great example. The world may be sliding into a Copper deficit over the coming years, impacted on the demand side by the continuing shift to a renewable energy infrastructure and electric vehicles as well as on the supply side through political disputes in producing countries. That this worsening deficit picture is happening amidst the downturn in Chinese property makes us wonder what happens if stimulus measures are enacted there. Oil markets are also likely to be in focus as the forces of incredible US supply growth creates tensions with OPEC production cuts and continuing Russia sanctions…and heightened tensions in the Middle East. It only takes a couple of million barrels a day either way on supply and demand to move markets a big way. Grain markets also may be coming off a period of low supply and see the high prices of the past couple of years dissipating. Managed Futures offers exposure to these uncertain commodity markets.

Summary

In our view, portfolios benefit from being adaptable and need to make the most of the tools that are available to best navigate uncertainty. Direct commodity exposures. Long exposures AND short exposures. Managed Futures gives that flexibility. The charts below show two different periods of maximum uncertainty – the GFC years and the inflation/war in Ukraine/rates years. This uncertainty was not good for traditional assets. Managed Futures was able to navigate the uncertainty and diversify. The color coding details the strategy exposures through the periods – the most interesting thing to us is that it shows the adaptability. In the GFC, the right thing to do was long bonds and short commodities. In the inflation years, the right thing was short bonds and long commodities. Managed Futures offer maximum flexibility to adapt to a wide range of outcomes.

You must be logged in to post a comment.